Conversations #21 - Beyond T-Bills

Around 80% of stablecoins are backed by US Treasury Bills. Considering US dollar denominated stablecoins represent more than 99.8% of the market, it is fair to say we’re witnessing the advent of the USD’s third vector of globalization and growth: crypto-dollars. Euro-dollars channeled Europe’s need of funding to rebuild after WWII, petrodollars captured the gargantuan market that petrol contracts would become. Stablecoins, in turn, are riding on the rise of internet financial markets. All of this with close to no policy effort.

While our European leaders are clinging to monetary monopoly and trying to service the old banking generation by forcing the way for a CBDC, the United States are embracing stablecoins much more warmly. The GENIUS act, their official legislation piece for the industry, just passed the Senate, and is set to be anointed in the coming days by the House. Many expect it to open the floodgates of private money. For the US, by the US, for the US.

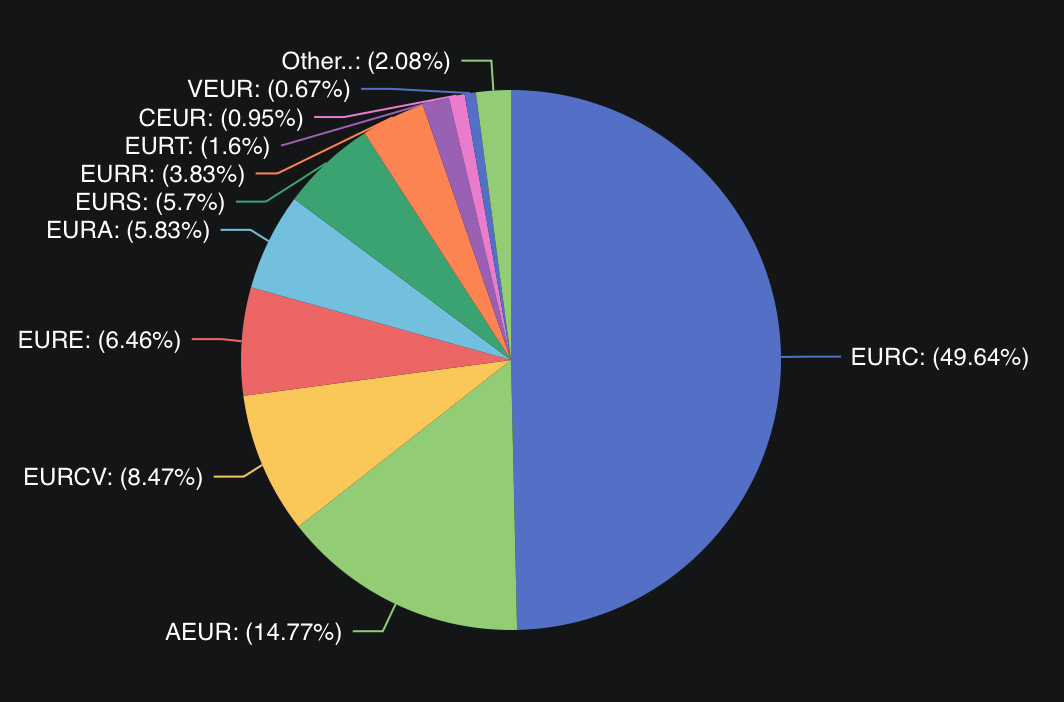

To most, this is a great victory. Sagacious DeFi builders will understand that the text is quite the opposite. Any algorithmic or crypto backed coin is strictly out of scope, which means this is a banking product and not a crypto product. Additionally, it is forbidden from distributing yield or interests at the issuer level. Ring any bells? Yes, this is the Tether / Circle model. You either have the distribution network to go and compete with them or you are simply not welcome in the US stablecoin economy. Despite this all, the GENIUS act is actually functional, unlike MICA. As with the French ICO regulation (Loi Pacte), I suspect we will not see any additional activity bloom in our region, as the 300M EUR of circulating supply seem to show. Hell, Trevee Earn has almost as much supply as the whole European stablecoin industry. Worse, American companies issue over 75% of the EUR stablecoins.

Beyond the fact that this American legislation is a play to maintain the banking status quo, with two outliers (Circle and Tether), there is a real interrogation mark on its backing. Issuers being obligated to emit stablecoins fully backed by cash or equivalents (ie: treasury bills with 93 days or less of maturity, reverse repo or government money markets). These assets are considered “Tier One” and the least risky allocation possible of the USD. I don’t think most readers will be surprised that I strongly disagree with this classification. Most backing of stablecoins are treasury bills. This means that for every dollar we hold, at least 79 cents of it is financing the American government. Those funds finance wars today. Besides agreeing or not with their political agenda, most stablecoin holders are simply not American. Instead of financing their own government's debt, local initiatives, they are relinquishing this right to the world's largest economic powerhouse.

In the wake of the disagreements around Trump’s annual budget (the Big Beautiful Bill), it is, as is becoming tradition, a non-zero occurrence that the US defaults on its debt. The very thing backing most of our industry. This is unlikely to happen in the short term, and the effects would be limited since the obligations are mostly short dated, but with some issuers becoming part of the top 10 buyers of treasury bills, I feel we’re taking a very worrying direction.

For now, I’ve given up on the idea a non-dollar stablecoin could be competitive at the global level. However, there are plenty of crypto backed dollar stablecoins who have it in them to become the outliers of this industry. I believe that a great algorithm is far more robust than the political pendulum. The liquidation engine of Aave for GHO, Curve’s pegkeepers for crvUSD and the stability mechanism of BOLD all seem more trustworthy in my eyes. DeFi’s true value has always been trustlessness. Today it seems that we’re sacrificing this core value for the sake of adoption. We will most likely have to suffer a few more black swans before going back on the right path.

GENIUS won’t unleash private money; it corrals it into rolling 93-day loans to Uncle Sam. Is that where you want your savings parked?